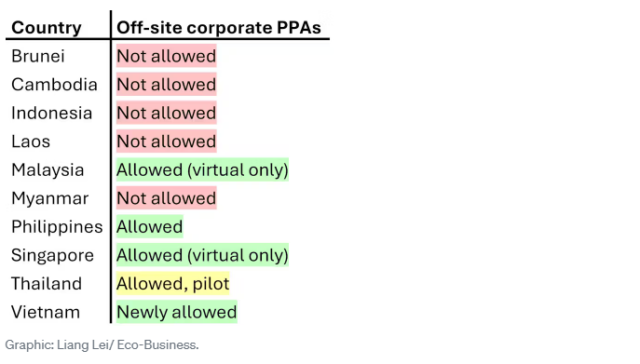

Vietnam’s recent opening up of its green power market won industry plaudits, but such reforms have been slow to materialise in the region. Eco-Business examines where firms may find procuring renewables easy, tricky, or nigh on impossible.

“This is a hugely welcome step in Vietnam as the country looks to position itself as a leader in renewables in the region,” said Ollie Wilson, head of the RE100 campaign, whose members have committed to support 100 per cent renewable electricity.

Indonesia, the largest Asean economy, had allowed the sale of excess green power from rooftops since 2018, but revoked it earlier this year – a move that observers had said would dent interest for future small-scale solar adoption.

Authorities had in parallel removed other fees for commercial users, so the brunt of the negative impacts would be felt instead by households, who never had to pay the business fees in the first place.

Other jurisdictions are trying to permit the sellback of rooftop solar power, but are facing difficulties doing so. Brunei had started trialling a “net metering” scheme since 2021, but does not appear to have moved past that stage, according to information on its energy department website. Cambodia hinted at similar measures last year.

Under net metering, businesses use advanced power meters to track how much solar power they send back to the grid, and accordingly receive discounts on their electricity bills.

There are also calls for governments to step up national renewables procurement schemes, to further add to green power demand. Such schemes were what propelled Vietnam’s renewables scene to Southeast Asia’s fore in 2018, although it has now emerged that the system was not well managed and led to the lengthy regulatory delay between 2021 and 2023. Developers now point to the Philippines, which has pledged annual auctions for new renewables projects, as a new role model.

But when it comes to enabling corporate renewable PPAs, all eyes are now back on Vietnam, to see if the country can make things work.